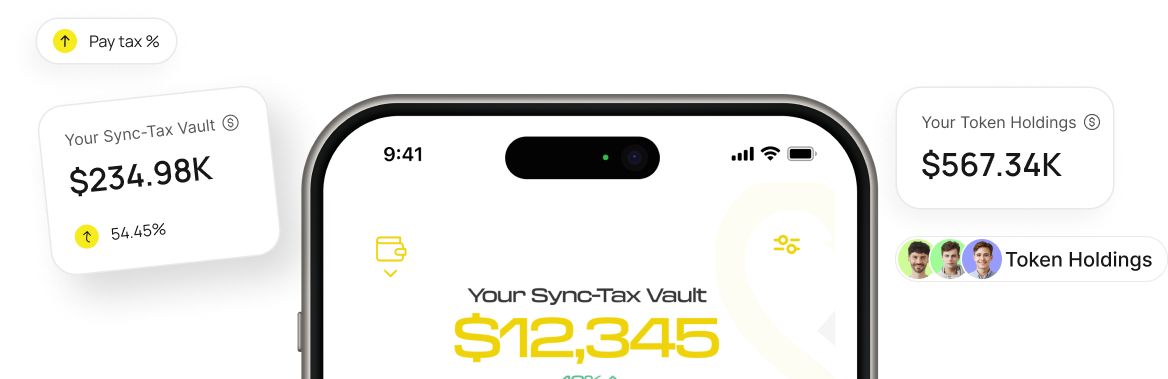

No-one does Tax like Sync-Tax

No-one does Tax like Sync-Tax

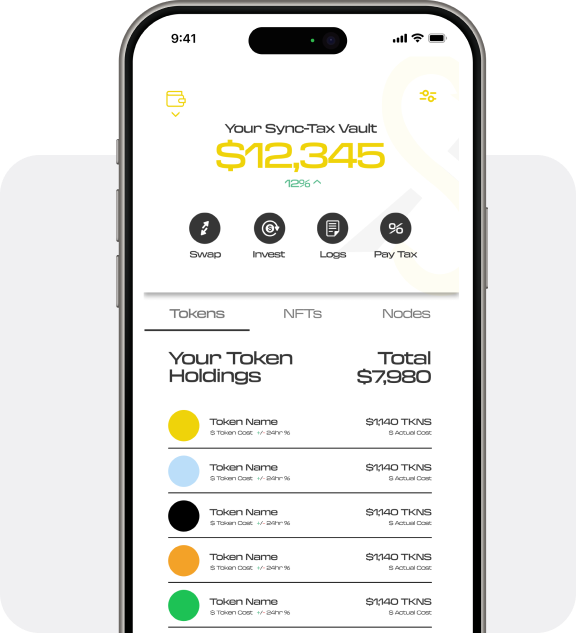

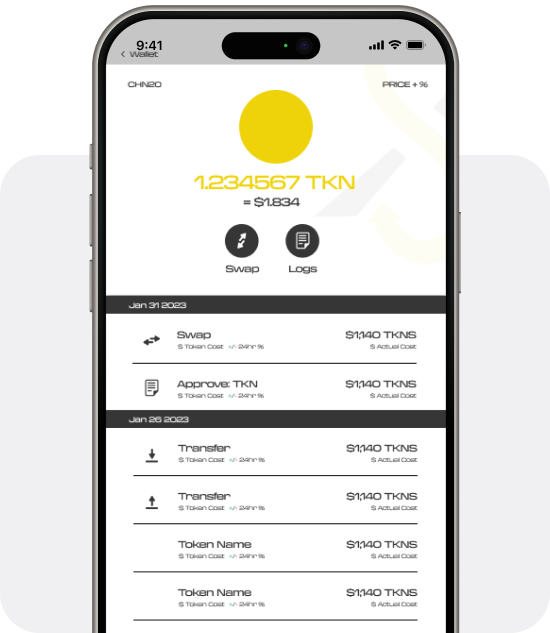

Effortless Crypto Tax Management for Everyone, from Beginners to Experts

An innovative, non-custodial solution that anyone can simply switch on and let Sync-Tax do the work for you. From seasoned adopters to first-time users, Sync-Tax’s automated simplicity means you’ll always remain on top of your crypto taxes.